Paycheck estimator ma

For example if an employee earns 1500. Enter your info to see your take home pay.

Payroll Calculator Free Employee Payroll Template For Excel

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

. It can also be used to help fill steps 3 and 4 of a W-4 form. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. The results are broken up into three sections.

Ad See the Paycheck Tools your competitors are already using - Start Now. Make Your Payroll Effortless and Focus on What really Matters. Next divide this number from the.

Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Read reviews on the premier Paycheck Tools in the industry.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This contribution rate is less because small employers are not. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Simply enter their federal and state W-4.

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

This number is the gross pay per pay period. Ad Join Other Business Owners Whove Made Their Payroll Management Easier. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Subtract any deductions and. It is also useful for. So the tax year 2022 will start from July 01 2021 to June 30 2022.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are going to be paid every month. Some states follow the federal tax.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Compare 5 Best Payroll Services Find the Best Rates.

Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887-6367 or 800 392-6089 which is toll-free in. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. Federal Salary Paycheck Calculator.

Below are your Massachusetts salary paycheck results. Paycheck Results is your. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts.

SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. This income tax calculator can help estimate your average. Massachusetts Hourly Paycheck Calculator.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. How do I calculate hourly rate. Calculating paychecks and need some help.

New employers pay 242 and new. Massachusetts Salary Paycheck Calculator Results. How to calculate annual income.

Just enter the wages tax withholdings and other information. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The state tax year is also 12 months but it differs from state to state.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Payroll Calculator Free Employee Payroll Template For Excel

Free Paycheck Calculator Hourly Salary Usa Dremployee

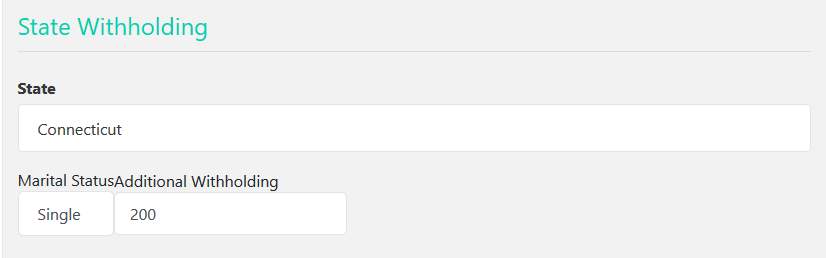

Connecticut Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Massachusetts Paycheck Calculator Smartasset

Massachusetts Salary Paycheck Calculator Gusto

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Here S How Much Money You Take Home From A 75 000 Salary

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Paycheck Calculator Hourly Salary Usa Dremployee